SBI Simply click credit card vs SBI Prime credit card 2023-2024 In this article we are comparing two different cards. These are two cards are SBI most popular cards. These two cards are SBI simply click credit card and SBI prime credit card. We compare these two cards Feature’s. Let’s compare the two cards briefly.

1) Renewal Fee and joining fee –

SBI simply dick joining and renewal fee is Rs.499 plus taxes and SBI prime card joining and renewal fee is RS.2999 plus taxes. Fee of both the cards was waive of Rs.1 lakh spent annually in case of SBI Simply click card.

In case of SBI prime card if you spend Rs.3 lakh annually then joining and renewal fee is waived. You get welcome benefits on both the cards. Its value is equal to joining fee.

2) Welcome Benefits–

Welcome Benefits in SBI simply click card Rs.500 Amazon pay gift card. You get Rs.3000 e–voucher on SBI prime card. You can avail e–voucher on many brands like Bata, hush puppies, pantaloons, yatra. Etc.

3) Milestone Benefits–

You get milestone benefits on both the cards. SBI simply click card clear tripe 2 voucher of Rs.2000 each on spends of Rs.1 lakh and 2 lakh. Only online spends, consider milestone benefits, simply click on credit card.

On SBI prime credit card you get a pizza hut voucher of Rs.1000 on top of Rs.50,000 quarterly spends and on Yatra, pantaloons e–voucher of Rs.7000 on top of Rs.5 lakh annual spend.

Some more benefits are available on SBI Prime Card. Like Trident hotels membership and club vistara silver membership. Club vistara is a great benefit for those who travel vistara. You get four on international travel lounge Access and eight complementary domestic lounge access.

4) Reward points–

SBI Simply click credit card vs SBI Prime credit card 2023-2024 simply click credit card Base reward rate is one point for every. Rs.100 you spent. SBI prime card the Base reward rate is two points for every Rs.100 spends. Accelerated reward points are given on both the cards. Like 10x reward points on exclusive online on simply click credit card Partners and the partners is Amazon, Book my show, clearstrip, lenskart.com, metmeds.com, Uc urbanclap.

Apart from this brand, if you spend online anywhere else, you get 5X reward points. Get 10X reward points on top of SBI prime credit card on utility bill payments using standing bill Instructions. In addition, you get 10x Reward Points when you spend on your birthday.

Plus you get 5x reward points wild on dining, grocery and movies. Reward points to you statement credit against or amazon, cleartrip etc. E–voucher against redeem. On an average one reward point value is RS.0.25 .

Now we compare in different spending habit or different spending ranges and see the what’s the card is better.

1)First case – Let’s assume one person “A” is regular expense and some expenses on movie and dining. It does all the expenses offline. Let’s assume suppose person “A” monthly spe.10,000 spends on utility bills like electricity, Phone bill, internet etc.

Apart from this Rs.5000 spend on grocery and Food, movies Rs.300 / month spent art. This person’s monthly spent Rs.80,000 and Yarely spent is Rs.2,16,000.

Let’s calculate the award rate of two cards .

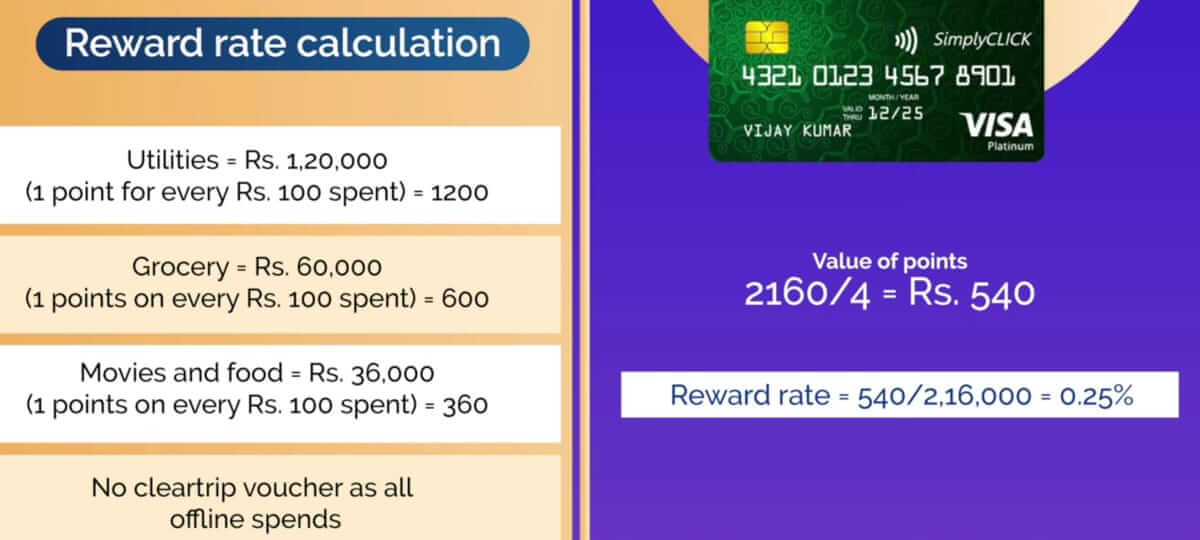

1) SBI simply click credit card–

Person if theoretically maximum total 2160 points can earn so the reward is 0.25%

In the image all calculations are shown. A person who spends normally and spends mostly offline. Simply click credit card for them is not recommended at all .

2) SBI prime credit card –

Now we will calculate the reward rate of some person if they have SBI Prime card. SBI prime credit card theoretically maximum total 33600 points can earn. Calculation of the reward rate is shown in the image.

So your reward rate using prime credit card is 4.35%. This is a very good reward rate. If your expenses are the same as person “A” then prime credit card is a better option for you .

2) Second case–

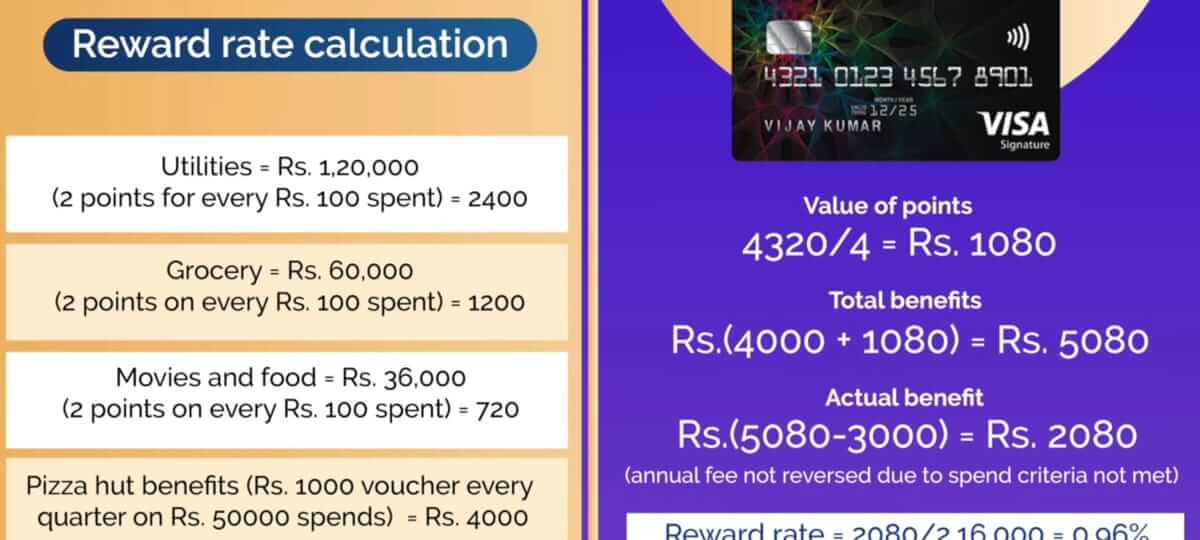

we assume person “B”. Person “B” spent is like Person “A” But he spent all in the online. So let’s calculate the rate reward rate in two cards .

1) SBI simply click credit card –

In this card theoretically maximum total 3000 points can earn. All calculations are shown in the image.

Then the SBI simply click credit card reward rate is 2.89%. when you spent online using simply click credit card reward rate is become better.

2) SBI prime credit card –

In this card person “B” theoretically maximum total 4320 points can earn. All calculations are shown in the image.

So the SBI prime Credit card reward rate is 0.96%. So online spending using SBI prime credit card reward rate is too bad. Simply click credit card is better than prime credit card. If you do normal expenses like person “A” and person “B”. Such as dining, utility bill, grocery’s, etc.

If you spend more then SBI prime card is better for you. Usually people use a combination of online and offline then in this case prime card is better. If your expenses are more than Rs.3 lakh per annum then SBI prime credit card is better for you.

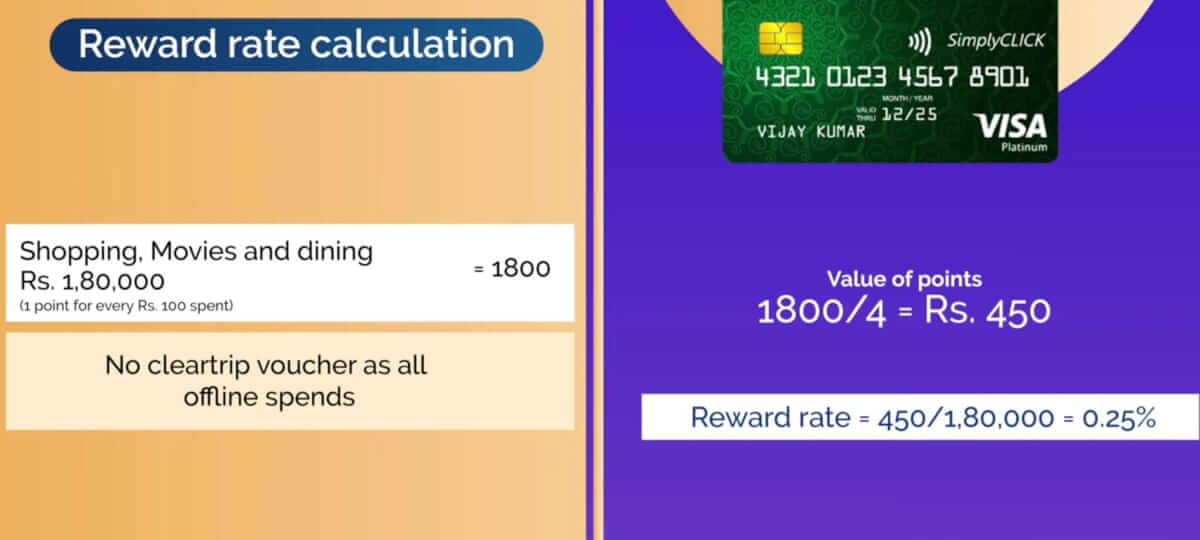

3) Third case–

Let’s assume person does not spent on “c” utility bill’s, grocery’s bills. Mostly spends on shopping, travel, food. Assuming all this is done in spent offline stores.

It has expenses like shopping on Rs.7000 per month, food on Rs.5000 per month, movies and entertainment on Rs.3000 per month. So the total monthly spent is Rs.15000 and yearly spent is Rs.1,80,000, Lets calculate reward rate .

1) SBI simply click credit card –

In this card person “c” thematically total maximum 18000 points can earn. All calculations are shown in the Image.

So the reward is 0.25%. For offline spent you cannot use this card.

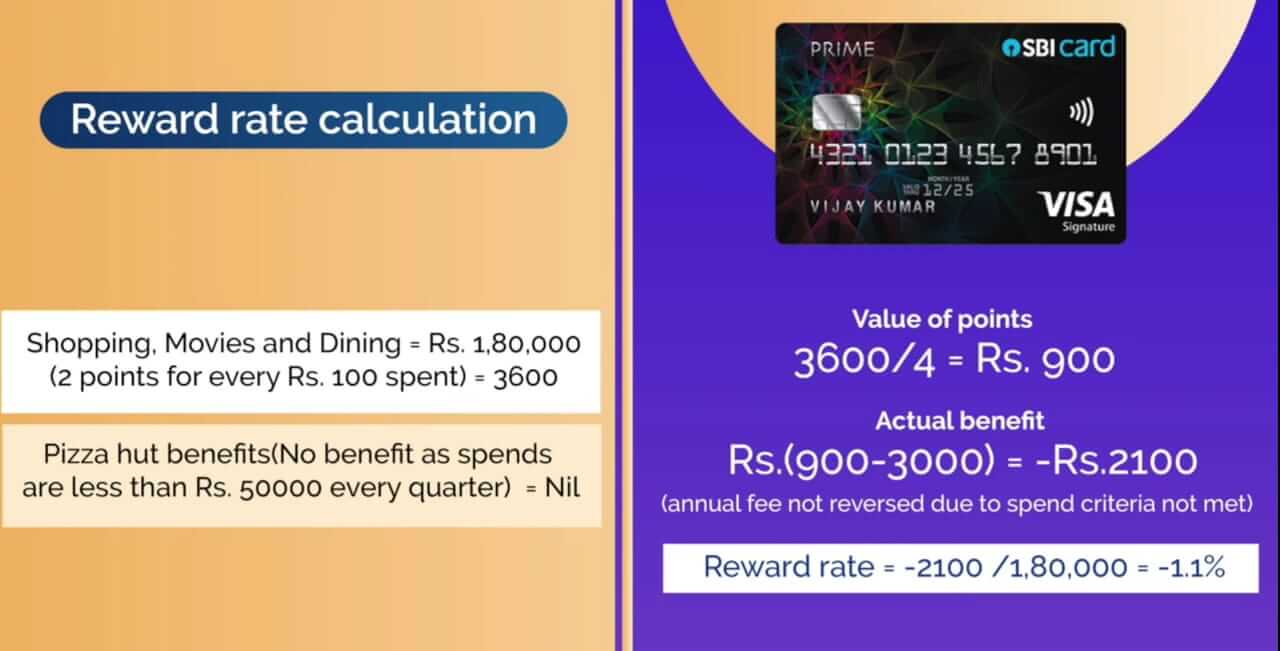

2)SBI prime credit card –

In this card person “C” theoretically maximum total total 52280 points can earn. All calculation shown in the image.

SBI Simply click credit card vs SBI Prime credit card 2023-2024 So the reward rate is –1.1% . so the reward is very bad and the negative return.