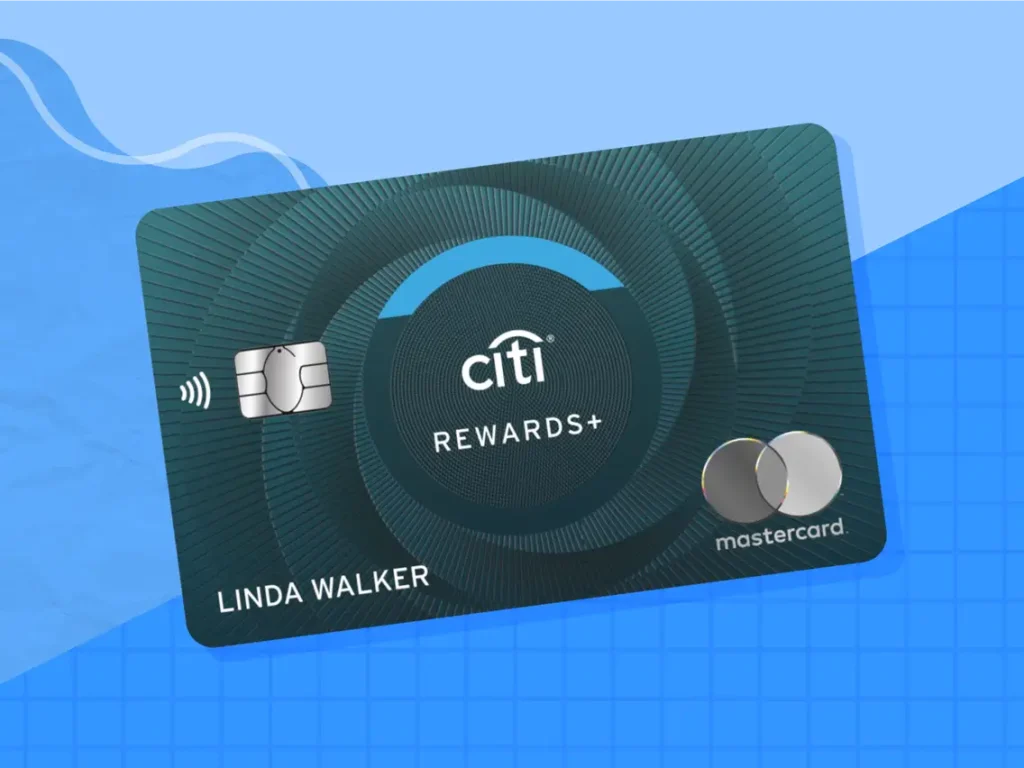

With all these features lined up on it, the Citi Rewards+®Card is a perfect credit card that fits the needed one for individuals who want to earn more as they spend. I found that range of benefits stated reflects the following advantages which are suited to those willing to spend and those who are willing to save:

In this extensive Citi Rewards+® Card review, we will focus on the main aspects of this credit card and both the advantages and some possible disadvantages. In this article, you will find all the important facts if you want to apply for this card or just compares it with the other ones.

Key information about the credit card

How does the annual fee work?

Another advantage that we can view distinctly at this is that Citi Rewards+® Card does not have an annual fee. This is a plus for cardholders since they can afford all the other benefits of the card without digressing to an extra yearly charge. Based on this, the lack of an annual fee makes it easy for one to earn the most from this card without extra charges.

How is the credit limit determined?

Credit limit decisions for the Citi Rewards+® Card are based on credit worthiness, income as well as other aspects concerning the applicant. Therefore, Citi assesses these criteria to determine whether the given limit is favorable for the holder of the credit card.

Advantages of the credit card

- 5x points on travel bookings: Earn five ThankYou® Points per dollar spent on hotel stays, car rentals, and attractions booked through CitiTravel.com until December 31, 2025.

- 2x points at supermarkets and gas stations: For the first $6,000 spent per year in these categories, you earn double points, making it ideal for everyday expenses.

- 1x points on all other purchases: Every other purchase earns you one point per dollar, ensuring you are rewarded no matter where you spend.

- Points rounding up: This unique feature rounds up your points to the nearest 10 on every purchase, enhancing your rewards significantly.

- 10% points back: When you redeem your points, you get 10% back on the first 100,000 points redeemed each year, adding extra value to your redemptions.

Standout advantage

One special feature that should be credited to the Citi Rewards+® Card is the “round up” element. What this means is that every time you use the card to make any purchase, it will round it off to the 10 points. For instance, a $2 parking meter fee will be equivalent to earning 10 points while a $12 purchase, 20 points.

Disadvantages

- Foreign transaction fee: The card charges a 3% fee on purchases made outside the United States, which can add up for frequent travelers.

- Balance transfer fee: After the introductory period, the balance transfer fee increases to 5%, which might be higher than some other cards.

- Variable APR: The variable APR ranges from 18.74% to 28.74% based on creditworthiness, which can be high if not managed properly.

A standout disadvantage

A limitation of this Citi card is that it has a foreign transaction fee that attracts 3% on each transaction made outside the United States. By doing so, this is likely to put a lot of cost in the account that can easily erase some of the gains available from being a reward member.

Who can apply for this card?

There are some requirements that have to be fulfilled by card applicants for one to be issued the Citi Rewards+® Card. First of all, it is necessary to state that only persons of the minimum age of 18 years can become our clients. Also, applicants should be able to provide proof of regular income needed to support the credit application and also, a good credit score.

How to apply for the Citi Rewards+® Card

For the website

To apply for Citi Rewards+® Card online, go to the official website of the company and find a section of the credit cards. Find the Citi Rewards + Card and click the on the apply now button. First of all, you are being asked to complete an application which contains fields for your name, address, social security number, and your income data.

Once you are done filling the form, ensure that the information given is correct and submit the application. Your application will be processed by Citi and you will receive the result usually within a few minutes. If the above application is approved, you will receive your new card in the mail within 7-10 business days.

Through the app

Like the previous step, using a mobile app to apply for the Citi Rewards+® Card is also easy. Go to the Apple Store or the Google Store and install the Citi Mobile application; if you have an account with this bank, use the same information to sign in, otherwise, register using the available options.

After login to the online banking service, go to the credit card part and choose Citi Rewards+® Card. Click the ‘Apply Now’ button on the page and complete the information in the application form as necessary. Make sure that you complete the form correctly and give the authentic information when filling it. The application status will be communicated through the app and if approved you will receive your new card through mail in a short while.

At the branch

If you think it is more convenient to fill in the application in the branch, you can go to a Citi center with a list of branches provided on Citi’s website. They apply through a first contact person who will help them fill the application forms. To make application for a personal loan, you will have to fill some details about yourself, income proof and identification documents.

The representative will guide you on how to fill the application form and even help you in submitting the same. With application in person one can ask all the questions one has concerning the card and the accruing advantages. After that, your application procedure will be processed by Citi and thus, once approved, you will have to wait for your new card in the post.