HDFC regalia vs HDFC millennia credit card which is better 2023-2024 in this article we can explain the Regalia vs millennia card. Regalia is a premium card and millennia is a master card. We compare the features and benefits of HDFC Regalia card and HDFC millennia card.

We compare these cards on various parameters like joining and annual fee, welcome benefits, milestone benefits and reward benefits.

1) Joining and renewal fee–

HDFC regalia card joining fee is Rs.2500 plus taxes and HDFC millennia joining fee is Rs.100 plus taxes. Renewal fee waive of when you spend using the HDFC Regalia credit card Rs.3 lakhs annually.

In case of HDFC millennia credit card, renewal fee is waived on annual expenditure of Rs.1 lakhs. Fees on millennia credit card are lower than Regalia credit card. And for millenia credit card renewal fee waive of less amount has to be spent. As a result, at the basic point of this point, millennia credit card is better than Regalia card.

2) Welcome Benefits–

In case of Regalia card you get 2500 reward points after paying Joining fee. One reward point maximum Possible value is Rs.0.25 in case of Regalia. Which means joining fee is not recovered.

– In case of millennia card as a welcome benefit 1000 cash points you get and one cash point value is Rs.1. so You get Rs.1000 benefits. Apart from this, if you spend Rs.30000 in a 90 days after getting card then your joining fee is reversed. In case of welcome benefit millennia card is far better than the Regalia card.

3) Milestone benefits–

HDFC regalia vs HDFC millennia credit card which is better 2023-2024 In case of Regalia card annually when you spend RS.5 lakhs you get 10000 reward points. Its maximum value is 5000 rupees. If you spend Rs.8 lakh annually you get additional 5000 reward points. The maximum value of which is Rs.2500.

– In case of millennia card milestone benefits are available only in first year. Which is when you spend Rs.1 lakh in a quarter then you get a Rs.1000 gift voucher. The milestone benefits of both the cards are not perfect.

– In case of millennia milestone benefits are available only in the first year and in case of Regalia card milestone benefit one has to spend a lot. So in this parameter these two cards are equal.

4) Airport Lounge access–

In case of Regalia card you can get a 12 domestic lounge access and 6 international lounge access. You don’t have any capping on this card that you can access lounge only a certain number of times in a quarter. You can access them any time of the year this card.

–In case of millennia you can get 8 complementary domestic airport lounge access in a year. Which is capped two per quarter and No international lounge access on this card. So clearly in the basis of airport lounge access Regalia card is betters

5) Reward benefits –

In case of Regalia card on this card you get four reward points above every RS.150 Spends and apart from this you get smart buy platform 5% cashback on hotels, amazon, flights etc.

Maximum cashback in one month is Rs.2000. Apart from this you get minimum RS.75000 spends in a quarter and you get Dineout passport membership of 3 months. Each is worth rape 750.

–In case of millennia card get 5% cash back on amazon, flipkart, hotel booking. In the form of cash points via payzapp app and smart buy platform. The minimum transaction is Rs.2000 and you can earn maximum 1000 cash points on each calendar month.

That means you can earn Rs.1000 cash back in the first 6 months after taking the card. After these 6 months you can earn maximum cashback in each calendar month is Rs.750. On top of all online spend using millenia card you get 2.5% cash points.

Maximum Rs.750 you can earn in a month. In this case also RS.2000 minimum transaction has to be done to earn points. This card gets 1% cash points on offline spends and wallet loading. Minimum transaction for 1% cash back should be RS.100. and maximum cash back you can earn in a month calendar month is a Rs.750.

6) Reward calculation–

we will see which card is better in both these cards above the reward benefit parameter from the example. For simplicity you don’t have to consider smart buy spends because not everyone on this platform will spend every month. Clearly get better benefit on smart buy spend on Regalia card.

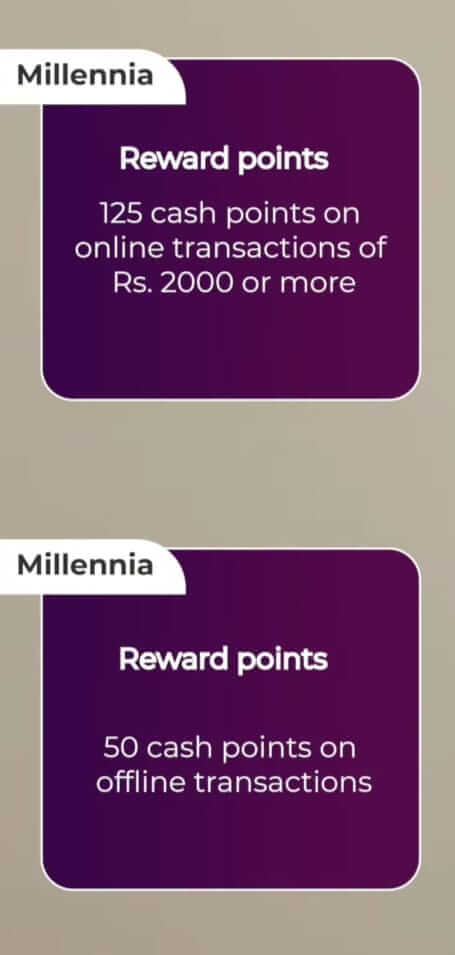

Let’s assume person “A” spends RS.20,000 in a month. Up to Rs.15000 online spends and Rs.5000 on offline spends. Rs.5000 transactions above 15000 online spends are transactions which are more than RS.2000. You get 266 total reward points on Regalia card. In case of millenia card gets 175 total reward points. The details information about the cash points present in image.

Some people may have more cash points. Most people don’t do minimum RS.2000 transactions. The maximum value of cash point of millennia card is one rupee which is more than regalia 0.25 paisa. But it is very difficult to get one rupee value. So the basis of reward calculation regalia card is better than the millennia card.

7) Reward points redemption –

HDFC regalia vs HDFC millennia credit card which is better 2023-2024 In case of regalia you get maximum value 0.50 rupees. If you make smart buy platform through hotel and flight booking. One reward point is equal to Rs.0.35 Value on product catalogue. One reward point equals to Rs.0.20 on statement credit. The validity of each reward point is two years.

– In case of millennia card redeem for cash point statement credit then one point is equal to one rupee. You get 0.30 paisa value on Flight and hotel booking. And product catalogue gives 0.30 paisa value.

One point validity only for one year in statement credit card in millennia credit card. For statement credit you will have to redeem minimum 2500 cash points. In real life statement taking credit is not easy.

People who spend more can accumulate 2500 points and take statement credit. Joining in 1st year earns 1000 points so you can get more credit in first year. It is very difficult to get a statement credit after the first year.

There are no better benefits than statement credit on millennia card compare to regalia. So the basis of redemption point Regalia card is better.

8)Suggestion –

The negative point of millennia card is that on this card you get Points on Rs.2000 transaction on online spends and 2500 points for statement credit. Points are valid for a minimum of one year. This card can be better if you make a little improvement on HDFC millennia card.

Regalia card is a little better card than millennia card but not everyone gets regalia card. People who do not get regalia card can apply for another good card like American express MR card, Amazon pay ICICI card and access ace card.